How Migration is Impacting Rental Ownership in the Western U.S.

Make no mistake—LOCATION is still the most critical consideration in real estate investing.

Put simply, demand determines location quality, and demand is largely a function of:

- Environmental desirability

- Economic opportunity

- Demographics

Assuming that supply is relatively constrained, a real estate market arguably should remain advantageous for investing, as long as these elements are present.

For years, select markets on the West Coast enjoyed uninterrupted preeminence across each of the above factors. Excellent weather, a robust economy and a reliable influx of westward and international immigrants all supported the California dream.

This has changed. A decade of persistent droughts and fires has tarnished the image of the SoCal lifestyle, not to mention the traffic and air quality. Relocated factories, closed military bases and diminished aerospace manufacturing have left an economy more dependent on service industries. While the region’s ports generate considerable movement of goods to other places, relatively little is actually made in the area. Meanwhile, Hollywood continues to export production to places like Vancouver and Atlanta.

And California leads the high-tax coastal states in overall taxation, ranking #1 in the U.S. in five major tax categories (statewide sales tax, gas tax, income tax, capital-gains tax and annual business franchise tax).[1]

Which leads us to the demographic factor: an unprecedented reversal in migration.

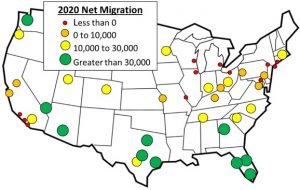

For the last seven years, more people have left California than arrived.[2] According to Marcus & Millichap, based on data from Moody’s and the U.S. Census Bureau, all three major coastal SoCal markets will experience negative migration in 2020 (see chart below)[3].

With regard to real estate values, this phenomenon can potentially spiral into a negative feedback loop, with more business exiting the state, thereby reducing economic opportunity, leaving fewer people to shoulder the tax burden, which in turn reduces demand…etc. The sunshine will always be a draw, but without economic opportunity and positive demographic support, California may no longer be the “LOCATION, LOCATION, LOCATION” it once was for investors. This may be especially true for owners of rental housing facing an historic onslaught of new anti-landlord regulations.

The changes leading to reverse migration in California are not likely to improve. Sacramento’s penchant for regulations and taxes, along with global warning, crumbling infrastructure and an exodus of industry, all point to a “new normal” for California demographics.

Yet other markets are showing opposite trends. Texas, Phoenix, Las Vegas, Seattle, Atlanta and Florida—despite its hurricanes and shrinking coastline—all continue to experience strong net migration. It is no coincidence that these states are generally more business-friendly, and more landlord-friendly, than California or Oregon. Indeed, Texas, Arizona and Washington are the top destinations for California emigrants.

Now is a good time to consider your options—not only in whether to sell your real estate, but in where to go to replace it.

For more information, please contact 1031 Capital Solutions at (800) 445-5908 or visit our website, 1031CapitalSolutions.com.

– – – – – – – –

[1] https://www.thebalance.com/california-state-taxes-amongst-the-highest-in-the-nation-3193244

https://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

https://howtostartanllc.com/taxes/llc-taxes/business-taxes

[2] https://www.nbcbayarea.com/news/local/californians-leaving-state-data/2078950/

[3] Marcus & Millichap, 2020 Multifamily Investment Forecast

This information is for educational purposes only and does not constitute direct investment advice or a direct offer to buy or sell an investment, and is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Because investor situations and objectives vary, this information is not intended to indicate suitability for any particular investor. The views of this material are those solely of the author and do not necessarily represent the views of their affiliates.

Investing in real estate and 1031 exchange replacement properties may involve significant risks. These risks include, but are not limited to, lack of liquidity, limited transferability, conflicts of interest, loss of entire investment principal, declining market values, tenant vacancies, and real estate fluctuations based upon a number of factors, which may include changes in interest rates, laws, operating expenses, insurance costs and tenant turnover. Investors should also understand all fees associated with a particular investment and how those fees could affect the overall performance of the investment.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment adviser. Insurance products offered through Concorde Insurance Agency, Inc. (CIA). 1031 Capital Solutions is independent of CIS, CAM and CIA.

continue reading

Related Posts

Changes are Happening Quickly – Don’t be Left Behind Managing […]

The Burdens of Managing Rental Property in Retirement Retirement should […]

Trusts, Partnerships and 1031 Exchanges One crucial aspect of real […]