Exchange Your Rental Before It’s Too Late

Residential landlords today are facing many challenges. In many coastal states, legislatures and city councils are imposing increasingly restrictive regulations. The White House proposes to limit future 1031 exchanges. And now the SEC is considering making private-placement properties available only to families with more than $10 million of assets. Being a mom-and-pop landlord has never been more challenging.

On the bright side, last year a record volume of investment real estate changed hands, and the market for 1031-qualified securities reached an all-time high. Many owners of rental SFRs, townhomes and condos sold properties over asking price to home buyers chasing a limited inventory of homes. The combination of demographic trends and low interest rates spurred unprecedented increases in owner-occupied home prices.

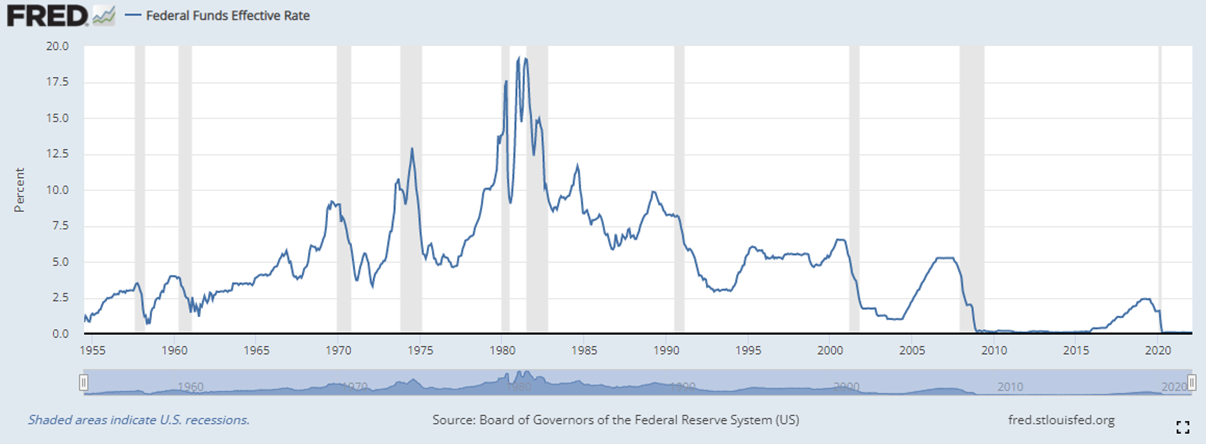

Yet this sellers’ market cannot last indefinitely. A new supply of houses and higher interest rates will level the current supply/demand imbalance. In some markets, owners of rental houses and condos will see their resale values once again re-coupled with prevailing cap rates, rather than driven by a bubble in the housing market. When that happens, you may find far less buyer demand for your West Coast rental home/condo than you enjoy today.

Increasing regulations, elevating tax burdens and negative migration do not bode well for left-coast rental properties in the long term. Not to mention that many of today’s owners are seeking to retire from being landlords. If you are interested in relocating your equity to greener pastures, now may be the best time to conduct a 1031 exchange into a passive replacement program.

_____________________

This is for informational purposes only, does not constitute as individual investment advice, and should not be relied upon as tax or legal advice. Please consult the appropriate professional regarding your individual circumstance. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax concepts, therefore you should consult your legal or tax professional regarding the specifics of your particular situation. There are material risks associated with investing in real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment adviser. Insurance products offered through Concorde Insurance Agency, Inc. (CIA) 1031 Capital Solutions is independent of CIS, CAM and CIA.

continue reading

Related Posts

Since 2021, the Federal Reserve has aggressively raised interest rates […]

When the Federal Reserve (the Fed) adjusts its target interest […]

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers […]