10 Reasons to Exchange into Passive Properties

10 Reasons to Exchange into Passive Properties

Conducting a 1031 exchange? Before buying another apartment building to own and operate, consider an alternative 1031 solution: passive replacement programs. Such strategies include:

- Delaware statutory trusts (“DSTs”)[1]

- Tenants-in-common (“TICs”)

- DST conversions to umbrella partnership real estate investment trusts (“UPREITs”)[2]

- Ground lease interests in development (“GLIDEs”)[3]

- Pooled oil/gas royalties[4]

Today, one of the more common of these options is the DST. In 2004, the IRS issued Revenue Ruling 2004-86, which affirmed that a taxpayer may exchange investment property for an interest in a DST, provided the program invests only in real estate—with one lease, one loan, one round of investors, one portfolio, all potential net income distributed to investors and no expenditures for major improvements.[5] In 2021, over $10 billion of real estate was acquired via §1031-qualified DST programs, almost entirely by individual investors.[6]

Prior to the Great Recession, a common form of syndicated §1031 programs was the TIC structure, in which multiple investors each owned, on title, a fractional interest in a property. But by 2010, DSTs had supplanted TICs as a solution among §1031-qualified real estate securities.

Why the shift? With DSTs, the IRS allowed attributes that did not exist previously in passive §1031 strategies:

- 100-300 investors in one program, rather than the limit of 35 under a TIC structure

- Opportunity to invest in a larger portfolio of real estate than TICs

- Only one borrower—the DST—rather than all investors being a party to the loan

- Virtual real estate ownership without being on title

- Ability of the DST manager to make decisions without a unanimous vote of investors, an often-problematic requirement for TIC programs

Passive replacement programs offer these ten key functions:

- Tax Deferral and Potential Avoidance

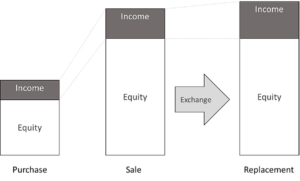

All of the above strategies are designed to qualify for a tax-deferred exchange of actively-owned rental property into a passive real estate investment. And with the exception of UPREITs, all of these options allow for subsequent §1031 exchanges. Unlike appreciated stocks[7], which cannot be sold/replaced without recognizing a gain, real estate held for investment (including DSTs, TICs, mineral interests, etc.) can be exchanged multiple times over one’s life. Moreover, all deferred capital gains taxes and depreciation recapture taxes potentially can be avoided altogether when the cost basis is “stepped up” at death.

- Truly Passive Ownership

In passive replacement programs, investors no longer suffer the common hassles of being a landlord:

| Advertising for new tenants | Bookkeeping costs | Listing agreements |

| Applicant screening | Tax or insurance bills | Notice requirements |

| Lease negotiations | Late-night emergencies | Threats of litigation |

| Tenant improvements | Calls with tenants/managers | Late rent/damages |

| Property maintenance | Loan payments | Evictions |

Rather, owners in passive replacement programs may receive periodic electronic deposits (if applicable, not guaranteed), pay attention to quarterly property updates, and forward tax statements to their accountants (for use in filing a Schedule E. With the exception of TIC interests, there are no voting requirements and no threats of capital calls.

- Institutional Management

Some individual landlords conducting a §1031 exchange own a single property in a single market with perhaps a handful of tenants, operated either by themselves or a small local property manager. Conversely, sponsored real estate investment programs offer the opportunity to own a fractional interest in:

- Tens or hundreds of millions of dollars of real estate

- Assets that were sourced and now operated by an institutional real estate firm, often with a demonstrable track record in acquiring/operating/selling investment-grade real estate assets on behalf of REITs, pension plans, endowments, partnerships, TICs and DSTs

- Properties managed by a regional or national property-management company with hundreds or even thousands of employees

- Programs that have been subjected to multiple layers of due diligence, with an offering memorandum that includes a professional business plan and detailed financial projections

- Diversification[8]

Passive replacement programs offer the potential for four levels of diversification:

- Tenants. With as little as $100,000, a §1031 exchanger may invest in a diversified rent roll that, in the case of multifamily, senior housing or self-storage portfolios, could include several hundred tenants.

- Asset classes. With a slightly larger exchange, a taxpayer may allocate to multiple investment strategies across different asset classes, including apartments, senior housing, medical office, NNN retail, industrial, office, self-storage and (when the pandemic is over) student housing.

- Many DST programs offer multistate portfolios, while most are single-property offerings. For example, with only $300,000, one could have fractional interests in an Arizona property, Colorado property, and a three-property portfolio in Texas, Georgia and Florida.

- Sponsors/Operators. A dozen real estate operators comprise two-thirds of the market for securitized passive replacement solutions. Former landlords can potentially benefit from the collective experience, resources and track records of multiple large, institutional firms in a single exchange portfolio.

- Potentially Higher Income

Assuming that a passive replacement property can sustain its projected distribution rate over the life of the program, it is possible that the typical offering will produce a higher yield than one’s current rental.

Fluctuations in distributions, if they occur, may be the result of material unanticipated changes in rental revenue, expenses, capital expenditures, or some combination thereof. Most offering memorandums include a detailed 10-year projection of revenues, expenses and distributions. The anticipated income potential may be attractive, especially compared to one’s current property. Furthermore, for some current owners, the depreciable improvements in a passive program may be greater than a landlord’s current apartment building, potentially resulting in less taxable income

(see next section).

- Potential to Reduce Taxability

Not all income is created equal. Landlords today likely are depreciating property based on the estimated value of their above-ground improvements from several years ago. In some markets, the land value of rental properties may exceed the improvement value. And regardless of the improvement/land ratio, the current annual depreciation deductions on highly appreciated property are only a small fraction of the current property value.

(Again, Diversification does not guarantee profits or guarantee protection against losses. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated.)

Conversely, some passive replacement programs offer properties with high ratios of improvement values to land values. For example, in a Midwest multifamily property whose value is 80% improvements, with an LTV of 50%, its potential annual depreciation will be 5.8% of its initial equity. In a new purchase, any annual income from the property below 5.8% of equity would be potentially sheltered from current income tax.

Of course, taxpayers in a §1031 exchange carry over their previous cost basis. They may benefit from additional depreciable basis to the extent that the depreciable improvements of the replacement property exceed both the improvement value of their previous rental and any unrecognized gain from its sale.[9] Individual results will vary; investors must consult with their tax professional to determine what potential tax benefits, if any, may be available from a particular investment.

- Built-in, Off-Balance-Sheet, Non-Recourse Financing

Suppose a landlord converted her prior residence to a rental property 10 years ago (before retiring) after living in the home for five years. The original home mortgage now has 15 years remaining and the outstanding principal is approximately 50% of the home’s value.

If she wants to conduct a complete §1031 exchange, she will need to replace the entire value of her rental property, including the loan. Like many retirees, her current income is lower than when she purchased the property as a residence. Obtaining an investment loan, as opposed to an owner-occupied loan, may be an underwriting challenge. Taking on new debt also may limit her ability to qualify for other loans (e.g., to buy a vacation property or boat).

In most DST programs[10], the acquisition loan typically is in place before the first investors exchange into the property. All loan terms are predetermined, and there are only two parties to the loan agreement: the bank and the trust entity. Despite not being a named party to the loan, the individual DST investors each receive “credit” for their share of the nonrecourse loan for purposes of complying with §1031.

Here is a comparison of financing options for a §1031 investment under $5 million:

| Investor is/has: | Typical DST Financing | Typical Personal Investment Loan |

| Loan qualification? | No | Yes |

| Loan application? | No | Yes |

| Party to loan agreement? | No | Yes |

| Personal recourse liability? | No | Yes |

| Direct loan payments? | No | Yes |

| Notarized closing documents? | No | Yes |

| Public record of loan? | No | Yes |

| Debt on their credit report? | No | Yes |

Other typical terms of DST loans include:

- 10-year duration

- Interest-only for 4 to 10 years

- Prepayment penalty/yield maintenance

- Initial and ongoing reserve requirements

- 45-60% LTV, with some sponsors offering “zero-coupon” programs at 75+% LTV

- Limited Legal Liability

For many landlords, there is no shield of liability protection between them and their rental property. Even for those individual owners who have an LLC or other business entity, many find themselves open to “piercing the corporate veil.” And if a landlord does not place each rental into a separate LLC, all properties may be at risk to the extent that liability exceeds insurance coverage.

DST investors, on the other hand, enjoy legal protection from personal liability related to property litigation (beyond invested capital). In a typical DST program, there is a master tenant, property manager, trust and large insurance policy between a property and the investors. Upon exchanging into a passive replacement program, investors can enjoy owning institutional real estate without worrying about the threat of liability. Sadly, the same cannot be said about conventional, directly-owned real estate.

- Fast, Simple and Transparent Investment Process

A general deterrent to §1031 exchanges, particularly for mom-and-pop investors, is the specter of conducting not one but multiple real estate transactions, including all of the paperwork (scores of initials and signatures, meetings with notaries, public filings, tax documents, etc.). Although one cannot avoid the traditional process to sell a rental property, exchangers certainly can have a better experience with the replacement:

- No escrow period

- No Notary Public

- Funds invested shortly after subscription

- DocuSign or other digital signature platform may be available—no wet signature required

- Streamlined application process is possible in many instances

Unlike typical real estate “broker packages” investors receive a Private Placement Memorandum (“PPM”) that is usually 200-300 pages long, delineating all material details, risks and financial projections. Among the top program sponsors, these PPMs are subject to due-diligence review by law firms, third-party consultants, independent broker-dealers and individual financial professionals. Before buying, investors in 1031 passive replacement programs can learn more about the property than in a typical transaction.

- Customizable, Flexible Investments into a Array of Potential Strategies

Subject to a typical minimum investment up to $500,000, we have found some sponsors are able to be flexible with former landlords who may be able to invest lesser investment amounts into a passive replacement program.[11] Need to re-invest precisely $867,539 of equity? No problem. This is in stark contrast to traditional real estate, where a desired replacement property rarely will be the same exact price as the relinquished property.

Because passive §1031 strategies have evolved into a robust market, at any time there are multiple potential solutions available. Most programs are fully subscribed in a matter of days, so the “menu” of available options is constantly changing. With the right consulting team, landlords can confidently pursue potential replacement strategies from any state in the country, no matter when they sell their apartment building or other rental property.

FEES AND RISKS

Securitized §1031 investment programs are more expensive than buying and operating one’s own real estate. Yet investors potentially receive considerable value for such cost, including but not limited to:

- Sourcing real estate from among thousands of listed properties around the United States and performing ongoing market research and data analysis

- Conducting intensive property-specific due diligence and preparing complicated financial models

- Securing optimal financing terms

- Engaging top property-management companies or, in some cases, utilizing in-house property management

- Executing value-add strategies on a massive scale

- Providing ongoing accounting and tax reporting

- Monitoring the property and the market to optimize disposition timing

- Years or decades of experience from firms that often are large operators of institutional-caliber real estate portfolios

Illiquidity Risk

Most programs illustrate a hold period up to 10 years, but there is no guarantee of a liquidation date. Under a DSTàUPREIT strategy, investors may ultimately acquire shares of a non-traded public REIT with periodic redemptions. There is no public market for program investor interests. Once invested, there is only a limited possibility to seek a buyer for program investor interests from among the other owners, and at a significant discount to current value. Investors should assume their invested funds will be unavailable for the duration of the program. There is no specified time at which a program portfolio will be liquidated.

Control Risk

DST investors have no control over leasing, financing, management or disposition.

Exchange Risk

The §1031 DST industry relies on IRS guidance that dates back only to 2004. There is not a body of case law or subsequent regulations to provide additional assurances that these programs will comply fully with IRS requirements for §1031 exchanges. Investors are not guaranteed an interest in the program until all agreements are signed and the exchange proceeds are transferred to the program. A purchase may be delayed and may not satisfy the timeliness requirements of IRC §1031.

Performance Risk

There is no guarantee that investors will receive any return. Investment may result in loss of entire principal. There can be no assurance that the investment objectives described in the PPM will be achieved. Past performance of other properties cannot be relied upon to assess the future performance of any program. Distributions are not guaranteed and may be sourced from non-income items and constitute a return of capital.

Sponsor Conflicts and Fees

A program sponsor and its affiliates are subject to conflicts of interest between their activities, roles and duties for other entities and the activities, roles and duties they have assumed on behalf of the program. Conflicts exist in allocating management time, services and functions between their current and future activities and the program. None of the arrangements or agreements between affiliated entities, including those relating to the purchase price of program properties or compensation, is the result of arm’s length negotiations. A program sponsor and its affiliates receive substantial compensation in the form of fees for acquisition, financing, asset management, property management and disposition. Although a sponsor may have a long track record, the entities it creates to manage individual programs typically have no operating history.

Leverage Risk

Most programs rely on leverage—an acquisition loan or similar form of indebtedness—to acquire the property. These are generally non-recourse loans, though some loans allow for “bad boy carve outs” in the event an investor commits an act such as declaring bankruptcy or committing fraud. There can be no assurance that the disposition of the property will allow for the repayment of outstanding indebtedness. Leverage has the effect of amplifying any percentage gain or loss on invested equity. If a program does not liquidate before any applicable interest-only period ends (typically five to seven years), loan amortization likely will result in reduced distributions to investors.

Transaction Risk

If the program property or portfolio has not yet closed, there is a risk that the purchase may not be consummated. Especially in the case of new or inexperienced program sponsors, it is possible that the program could be delayed in, or fail entirely to, raise the offering amount.

Real Estate Risk

Program investors are buying real estate, with all of the risks inherent in any real estate investment, including:

- General acquisition, ownership and operational risks

- Environmental, regulatory, zoning and easement issues

- Increased competition and decreased occupancy

- Unforeseen maintenance, repairs and capital expenditures

- Macroeconomic changes, including interest and cap rates

- Tenant acquisition, retention and re-leasing costs

Although significant due diligence may be performed by sponsors, lenders, third-party consultants, appraisers, broker-dealers and registered investment professionals, this does not ensure that an investment will perform as projected. There may be issues that are not discovered through due diligence prior to or following an investor’s subscription in a passive §1031 program, which may cause an investor to incur losses up to the entire amount of the investment. The risks set forth herein are not exhaustive of all investment risks, and certain programs have greater or different risks than others.

This is for informational purposes only, does not constitute as individual investment advice, and should not be relied upon as tax or legal advice. Please consult the appropriate professional regarding your individual circumstance. DST 1031 properties are only available to accredited investors (typically defined as having a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last three years; or have an active Series 7, Series 82, or Series 65. Individuals holding a Series 66 do not fall under this definition) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney. There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk. A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. Offerings are made only by Prospectus or PMM. Investors should read the PPM carefully before investing paying special attention to the risk section. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment adviser. 1031 Capital Solutions is independent of CIS and CAM.

[1] A Delaware Statutory Trust is a common structure for investment companies like mutual funds, closed-end funds, interval funds and BDCs, due to favorable regulations afforded under Delaware law.

[2] Under IRC §721, it is possible to convert property, including DST interests, to the underlying partnership of a REIT, in exchange for ownership units that later can be converted to REIT shares. Conversion to REIT shares is a taxable event, typically done in anticipation of a sale or redemption of REIT shares. UPREIT interests cannot be exchanged again in a tax-deferred transaction, and do not qualify for §1031 exchanges.

[3] Under a GLIDE program, DST investors own a long-term ground-lease interest in vacant land, of which an affiliate of the sponsor is the master tenant and developer. The developer makes periodic rent payments to the DST during development and lease-up, ultimately with the intent to repurchase the ground-lease interest from the DST.

[4] Investors invest in a “basket” of fractional oil/gas royalty interests in real estate, each of which is recorded individually. Income and asset values vary based on energy prices, current production and future well development, among other factors.

[5] https://www.irs.gov/irb/2004-33_IRB#RR-2004-86

[6] Mountain Dell Consulting, LLC

[7] Notwithstanding stocks held in a qualified retirement account, of course

[8] Diversification does not guarantee profits or guarantee protection against losses.

[9] If the purchase price of a DST interest (including the investor’s share of nonrecourse liabilities) exceeds the fair market value of the interest, an investor may not be entitled to take depreciation deductions to the extent the interest is derived from nonrecourse liability.

[10] We are aware of only one DST sponsor that offers flexible individual investment loans, to which the investor is a named party.

[11] Most DST programs have stated minimum investment amounts between $100,000 and $500,000. Through our practice, we have found some syndicated DSTs allow for lower or odd investment increments down to the penny.

bd-bk-gp-a-1369-10-2023

continue reading

Related Posts

When the Federal Reserve (the Fed) adjusts its target interest […]

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers […]

When it comes to building and preserving generational wealth through […]