Assessing Inflation’s Impact on Commercial Real Estate

Assessing Inflation’s Impact on Commercial Real Estate

Investors typically consider inflation a threat to their portfolios, and with the annual inflation rate inching above 9% in June to a new 40-year high, it’s no surprise that 70% of Americans view inflation as the biggest problem facing our country.[1]

Higher inflation rates certainly can have a negative impact on consumer spending and purchasing power, which affects everyone’s pocketbooks…and puts increased pressure on investment returns to retain value in portfolios.

Inflation tends to affect different asset classes in different ways. For example, inflation generally has a negative effect on assets with fixed, long-term cash flows, such as bonds or CDs. Stock investment performance varies based on how much discretionary consumer spending is connected to the goods and services of the underlying company, or how much rising material/labor costs impact the company’s bottom line.

So called “hard assets”, such as precious metals and real estate, which tend to retain or even increase their value over time, have historically performed well during inflationary times. Real estate market participants commonly view the asset class as an “inflation hedge” based on its general ability to beat inflation over the long run. However, can this truly be applied “across the board”?

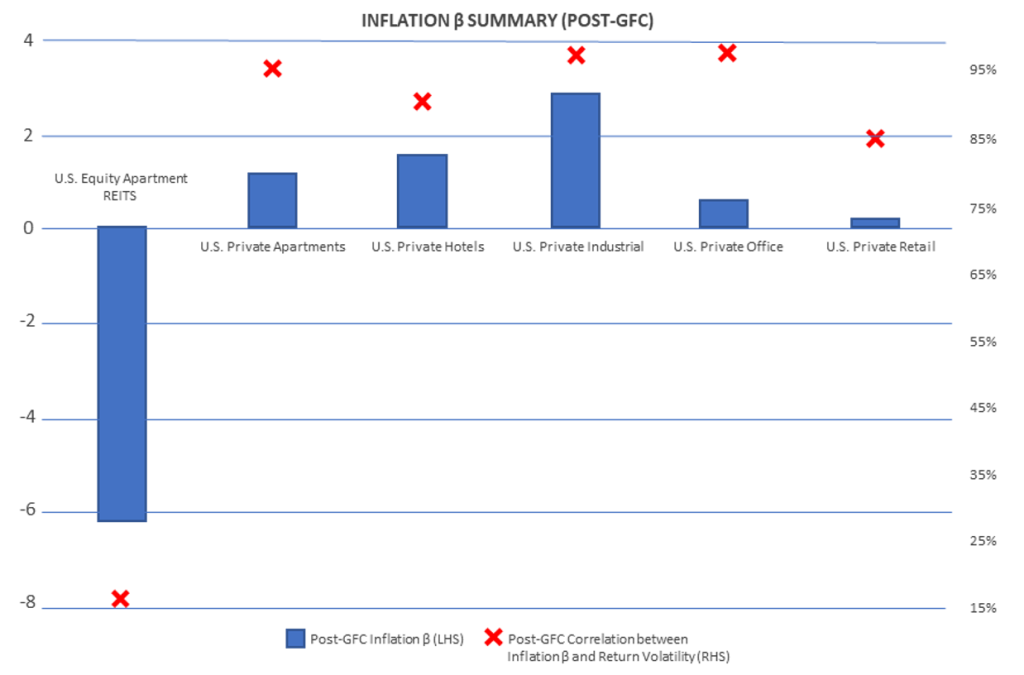

Fortunately, there is a metric that helps quantify the sensitivity of returns to changes in the inflation rate. Inflation ß quantifies the implied marginal rise or decline in excess returns given a rise in the inflation rate. An asset with inflation ß of two implies that for a 1% rise in inflation, excess returns will rise by 2%. As measured by inflation ß, a favorable inflation sensitivity is when excess returns tend to rise with rising inflation. Therefore, a higher inflation ß is better.

Within commercial real estate, U.S. equity REITs and the broader U.S. stock market, a recent research report by Berkadia showed that post-Global Financial Crisis (post-GFC), a 1% rise in inflation implies a 1.20% rise in private commercial real estate excess returns. Over the same period, a 1% rise in inflation implies a decline in the returns of REITs (5.27%) and the stock market (2.49%).[2]

As the chart below summarizes, post-GFC, all U.S. private commercial real estate property types tend to become more favorably sensitive to rising inflation when volatility is higher. Apartment REITs share this quality but to a much lesser extent.

While potentially a worthwhile inflationary investment option to consider, private commercial real estate is not without its downsides…starting with one of the features that often insulates it from the volatility of the market. Unlike publicly traded positions that can be traded at the click of a button, private commercial real estate investments are inherently illiquid and more difficult to trade if and when performance drops.

Of course, not all commercial real estate opportunities are the same. Performance in this asset class tends to be highly localized—something investors should consider before generalizing that commercial real estate is a good investment.[3]

Though it is unknown how long this current inflationary economic period will last, investors seeking an inflation hedge may want to consider increasing their exposure to private real estate. For current owners who are ready to retire from being a landlord, there are passive real estate investments that may allow investors an ability to move from an active to a passive role of real estate ownership on a tax-deferred basis.

For more information about tax-advantaged securitized real estate investments, please call 1031 Capital Solutions at 1-800-445-5908 or visit our website, 1031capitalsolutions.com.

_____________________

Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor.

This is for informational purposes only, does not constitute as investment advice, and is not legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Statements concerning financial market trends are based on current market conditions, which will fluctuate. Past performance and forecasts do not guarantee future results. Investments in securities involve a high degree of risk and should only be considered by investors who can withstand the loss of their investment. Prospective investors should carefully review the “Risk Factors” section of any prospectus, private placement memorandum or offering circular.

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically, no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the Prospectus.

The data contained in this material was obtained from third-party sources believed to be reliable; however, 1031 Capital Solutions, CIS, and CAM do not guarantee the accuracy of the information.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC-registered investment adviser. 1031 Capital Solutions is independent of CIS and CAM.

[1] Pew Research, Americans View Inflation as Top Problem Facing Country Today, May 12, 2022

[2] Berkadia, A Better Way to Assess Inflation and Risk in Real Estate, 2021

[3] PointAcquisitions.com, Pros and Cons of Commercial Real Estate Inflation, May 27, 2022

continue reading

Related Posts

When the Federal Reserve (the Fed) adjusts its target interest […]

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers […]

When it comes to building and preserving generational wealth through […]