Fed Targets and Interest Rates

Even if Fed Targets Remain Steady, Rate Could Creep Up – Spring 2024

U.S. inflation rose in January, likely marking the highest increase in a year according to the Federal Reserve’s preferred metric, the core Personal Consumption Expenditures price index (up 0.4% over the previous month). This increase, excluding food and energy costs, would be the second consecutive monthly acceleration after a period of decline over the past two years. Other pending metrics (durable goods, manufacturing reports, home sales) also are likely to be consistent with an inflationary trend. Federal Reserve officials emphasize their cautious approach, stating that they will only consider rate cuts once they are confident that inflation is constantly decreasing.i

Because some inflationary factors may be temporary, there is room for optimism that, at worst, we have seen the peak of rate hikes from the Fed. But does that mean rates are destined to fall any time soon? Perhaps not.

Despite the Fed’s likely intent to maintain level rates in the short term, one of its key levers may be losing its effectiveness. Specifically, there has been a marked decline in participation in the Fed’s program called the overnight reverse purchase facility, which has helped the U.S. government manage its borrowing costs. This program allows financial firms to temporarily exchange cash for securities and earn interest. Declining use of this program may be a signal of potential higher interest rates and increased volatility in the Treasure market.ii

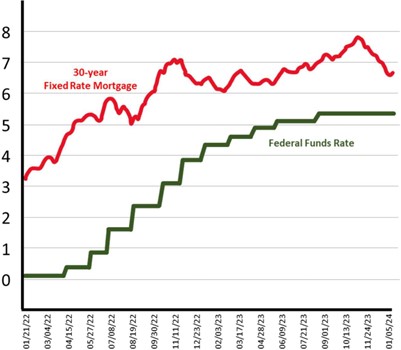

Furthermore, the Fed does not directly dictate rates in the lending market. As shown below, the Federal Funds rate certainly influences the average rates of a 30-year fixed mortgage loan, but the short-term deviations (aka the “spread”) between the two metrics from January 2022 to January 2024 are striking.iii

Indeed, not only can mortgage rates lag behind Fed moves, but other economic forces-changes in GDP, unemployment, taxes, vacancy rates, stock market trends- can impact prevailing mortgage rates, in the same way that operating risk and available market capital affect the spread between treasuries and real estate cap rates.

If you are waiting to sell a property or refinance a loan until interest rates subside, you may be in for a longer wait than pundits suggested at the beginning of the year. And as loans mature, distressed sellers may start flooding the market with properties they cannot afford to refinance. While this may be a good buying opportunity for some, it could get rough later this year for sellers. Do not let interest rates be the only factor in deciding how to time your sale.

This information is for educational purposes only and does not constitute direct investment advice or a direct offer to buy or sell an investment, and is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Because investor situations and objectives vary, this information is not intended to indicate suitability for any particular investor. The views of this material are those solely of the author and do not necessarily represent the views of affiliates. Statistical data contained in this material was obtained from third-party sources believed to be reliable; however, 1031 Capital Solutions, CIS, CAM, and CIA do not guarantee the accuracy of the information. Past history is not indicative of future results.

Investing in real estate and 1031 exchange replacement properties may involve significant risks. These risks include, but are not limited to, lack of liquidity, limited transferability, conflicts of interest, loss of entire investment principal, declining market values, tenant vacancies, and real estate fluctuations based upon a number of factors, which may include changes in interest rates, laws, operating expenses, insurance costs and tenant turnover.

Investors should also understand all fees associated with a particular investment and how those fees could affect the overall performance of the investment.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment adviser. Insurance products offered through Concorde Insurance Agency, Inc. (CIA). 1031 Capital Solutions is independent of CIS, CAM and CIA.

i https://www.bloomberg.com/news/articles/2024-02-24/world-economy-latest-fed-favored-inflation-gauge-seen- rising-most-in-a-year

ii https://www.wsj.com/economy/central-banking/treasury-markets-are-losing-their-shock-absorber-75ed6ea1

iii https://www.hsh.com/indices/federal-funds-vs-prime-rate-mortgage-rates.html

bd-eh-gp-a-305-2-2024

continue reading

Related Posts

When the Federal Reserve (the Fed) adjusts its target interest […]

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers […]

When it comes to building and preserving generational wealth through […]