It May Be Time to Let Go of your SFR, Condo or Townhome Rental

It May Be Time to Let Go of your SFR, Condo or Townhome Rental

All good things must come to an end, including the tenure of one’s rental property ownership. The circumstances that prompt a sale decision will vary from owner to owner, but often include such factors as:

- Maintenance hassles

- Looming capital expenditures

- Screening and selection regulations

- Rising insurance costs

- Higher state/local taxes

- Increasing legal liability

- Deposit restrictions

- Rent caps

- Eviction nightmares

- “Just cause” tenant removal

But for rental housing providers who own SFRs, condos and townhomes, there is arguably a more compelling impetus to sell than any of the above issues: your yield as a percentage of your equity may have fallen to unjustifiably low levels.

In virtually all other sectors of investment real estate, property values are tied very closely to net operating income. For example, assuming little change in capitalization rates over time, a light- industrial property whose net operating income doubles over 10 years will likely appreciate nearly 100%. In commercial real estate, income drives value.

With homes, however, other forces besides rental income drive resale prices. This is because every SFR, condo or townhouse rental is always a potential owner-occupied property. The supply/demand, macroeconomic, and demographic factors driving owner-occupied home prices obviously have little correlation to what the rental rates would be for those same properties.

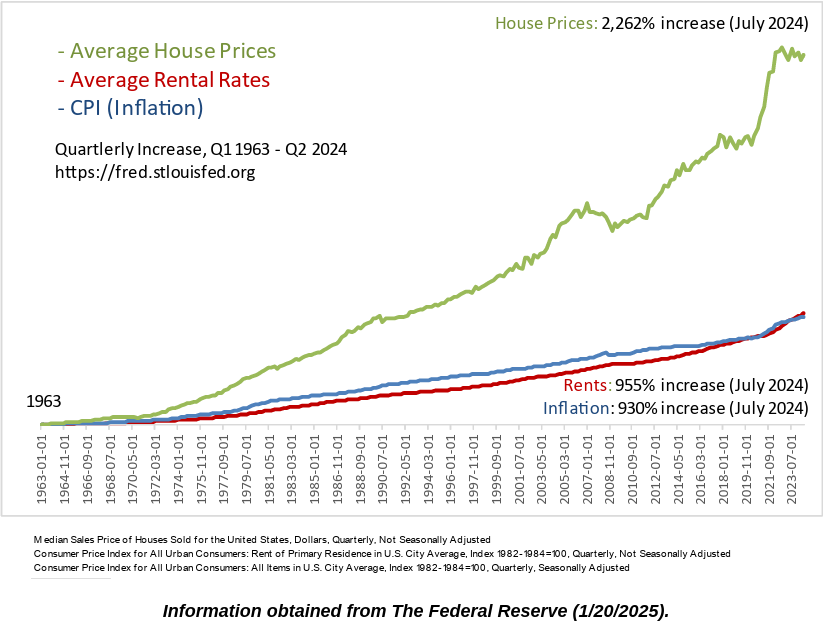

The chart below shows quarterly Fed data for three metrics since Q1 of 1963: home price increases, rent increases, and inflation increases. Note that average rents in the United States have increased at nearly the exact rate as overall inflation, just edging out the CPI in the last few years.

Home prices are a different story. Over 60 years, the average U.S. home price has increased by 2,262%, roughly 2.4 times the rate of rent growth (955%).

Information obtained from The Federal Reserve (1/20/2025).

Put another way, the average rental property purchased in 1963 for $40,000 would be worth approximately $905,000 today. If the rent in 1963 for this house was $300 per month, today it would be $2,865. Not bad, right?

Wrong. Assuming a 30% expense ratio after increases in taxes, insurance, maintenance, utilities, etc., the net operating income would be about $24,000 per year. If the equity is $850,000 after sale costs, the property now is earning a mere 2.8% annual yield on equity.

Going back only 16 years, the average price of a home is the U.S. has doubled (100%), while rents have increased by 70%. In certain markets on the West Coast, however, there is a much greater delta between home-price growth and rental growth (e.g., San Diego, South Orange County, Silicon Valley, Seattle). In some of these areas, we routinely see rental properties whose yield—as a percentage of equity—are below 2%.

You may be thinking, why should I sell my rental SFR or condo if it has appreciated so well?

First, your “dead” equity, if relocated to another property paying a modest 4% annual yield, could generate twice the cash flow of a property only yielding 2%.

Perhaps more importantly, the factors that drove your home values up over the last 10 years may not apply to the next 10 years.

Ask yourself this question: will these factors improve for my property over the next decade?

- Local population growth

- Local job growth

- Local household formation

- State/local taxation

- Insurance costs

- Tenant acquisition expenses

- State/local landlord regulations

- Deferred capital expenditures

If you think these factors are all trending positive for your property/neighborhood, then by all means, hold on to that rental. But if you think your SFR, condo or townhome may not be much more valuable in a few years to an owner-occupier compared to today, you should consider relocating your equity—via a 1031 exchange—into passive property located in a market with greater long-term demographic and economic upside potential.

At a 1031 Capital Solutions, we are happy to provide a complementary Cash Flow Analysis for AAOA members and subscribers to Rent magazine. Let us help you make an educated decision on whether to keep, sell or exchange your rental property.

____________________________________________________________________________________

This information is for educational purposes only and does not constitute direct investment advice or a direct offer to buy or sell an investment, and is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Because investor situations and objectives vary, this information is not intended to indicate suitability for any particular investor. The views of this material are those solely of the author and do not necessarily represent the views of affiliates. Statistical data contained in this material was obtained from third-party sources believed to be reliable; however, 1031 Capital Solutions, CIS, CAM, and CIA do not guarantee the accuracy of the information. Past history is not indicative of future results.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment adviser. Insurance products offered through Concorde Insurance Agency, Inc. (CIA). 1031 Capital Solutions is independent of CIS, CAM and CIA.

continue reading

Related Posts

Since 2021, the Federal Reserve has aggressively raised interest rates […]

When the Federal Reserve (the Fed) adjusts its target interest […]

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers […]