1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers

Richard Gann and Jason McMurtry—Managing Partners of 1031 Capital Solutions—recently launched Exchange Illustrator for rental housing

providers to evaluate their investments and decide whether to keep, sell or exchange their properties. Exchange Illustrator is also a valuable tool

for real estate professionals seeking to add consultative value to their practice.

Exchange Illustrator offers multiple modules for rental housing owners:

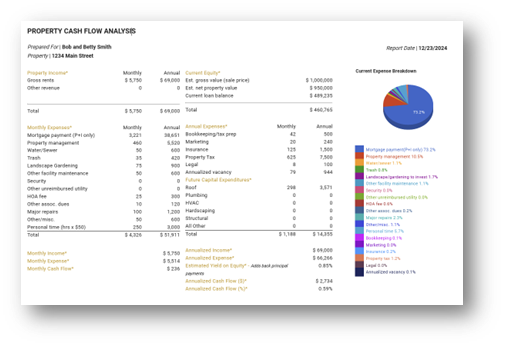

- Cash Flow Analysis

This module snaps a quick X-ray of the financial health of your current rental property. Factoring all revenues and expenses (including personal time,

future capital expenditures, vacancies and turnover costs), one can determine key metrics like annualized Cash Flow and Yield on Equity. These

bottom-line results are crucial to making an apples-to-apples comparison between an existing rental property and other potential investment options.

The hypothetical example is for illustration purposes only. Individual results may vary.

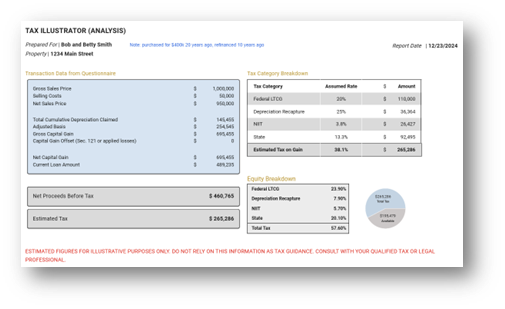

- Tax Estimator

Having made the decision to sell, the next question is whether to receive taxable sales proceeds or conduct a tax-deferred 1031 exchange. The Tax Estimator

module estimates the tax consequences of selling an appreciated rental property, factoring such elements as prior capital expenditures,

cumulative depreciation, offsetting losses/credits, and state taxes.

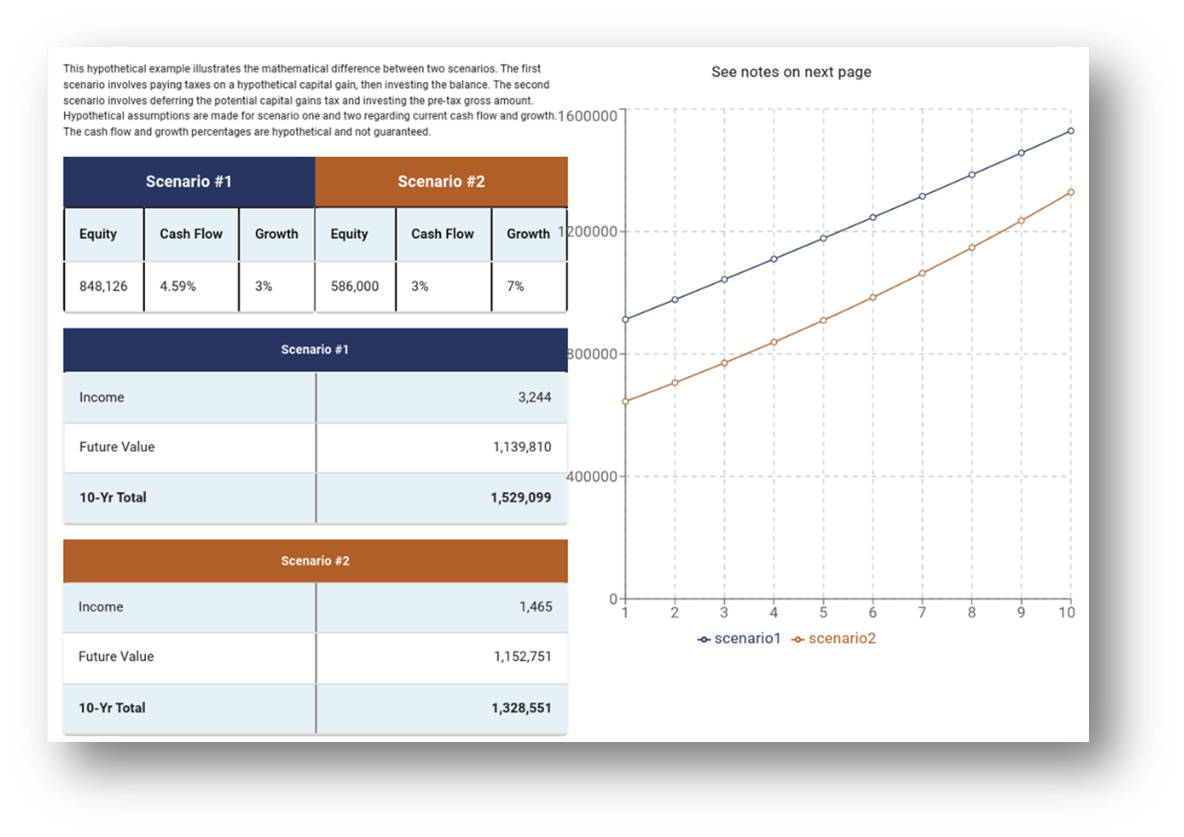

- Cash-Out Comparison

Some “financial advisors” will advocate for their clients to forego a 1031 exchange and invest their after-tax proceeds in Wall Street securities,

with the premise that a stock portfolio will “make up the taxes”. This module provides a simple tool to check the math—often debunking the

proposed rationale for incurring unnecessary taxes.

- NOI/Cap Rate Sensitivity Analysis

Lastly, for any proposed real estate investment, this module generate a grid with 35 scenarios to understand how future changes is property NOI and

applicable capitalization rates will impact a property’s future return on a seven-year hold.

__________________________________________________________________________________________________

The best part of Exchange Illustrator is that it is free to use for both real estate professionals and rental property owners: click here to get started.

Richard D. Gann has been a member of the State Bar of California since 1997, and Jason McMurtry has an MBA from South University. Both are the Managing Partners of 1031 Capital Solutions and co-authors of the book, How to Retire from Being a Landlord. For more information about passive real estate investments and 1031 exchanges, please call 1031 Capital Solutions at 1-800-445-5908 or visit our website, 1031capitalsolutions.com. Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM). 1031 Capital Solutions is independent of CIS and CAM. Exchange Illustrator software is owned and offered by AltsIllustrator, LLC, an outside business activity of Richard Gann and Jason McMurtry, and not affiliated with CIS and CAM.

continue reading

Related Posts

When the Federal Reserve (the Fed) adjusts its target interest […]

When it comes to building and preserving generational wealth through […]

How to Report a 1031 Tax-Deferred Real Estate Exchange to […]