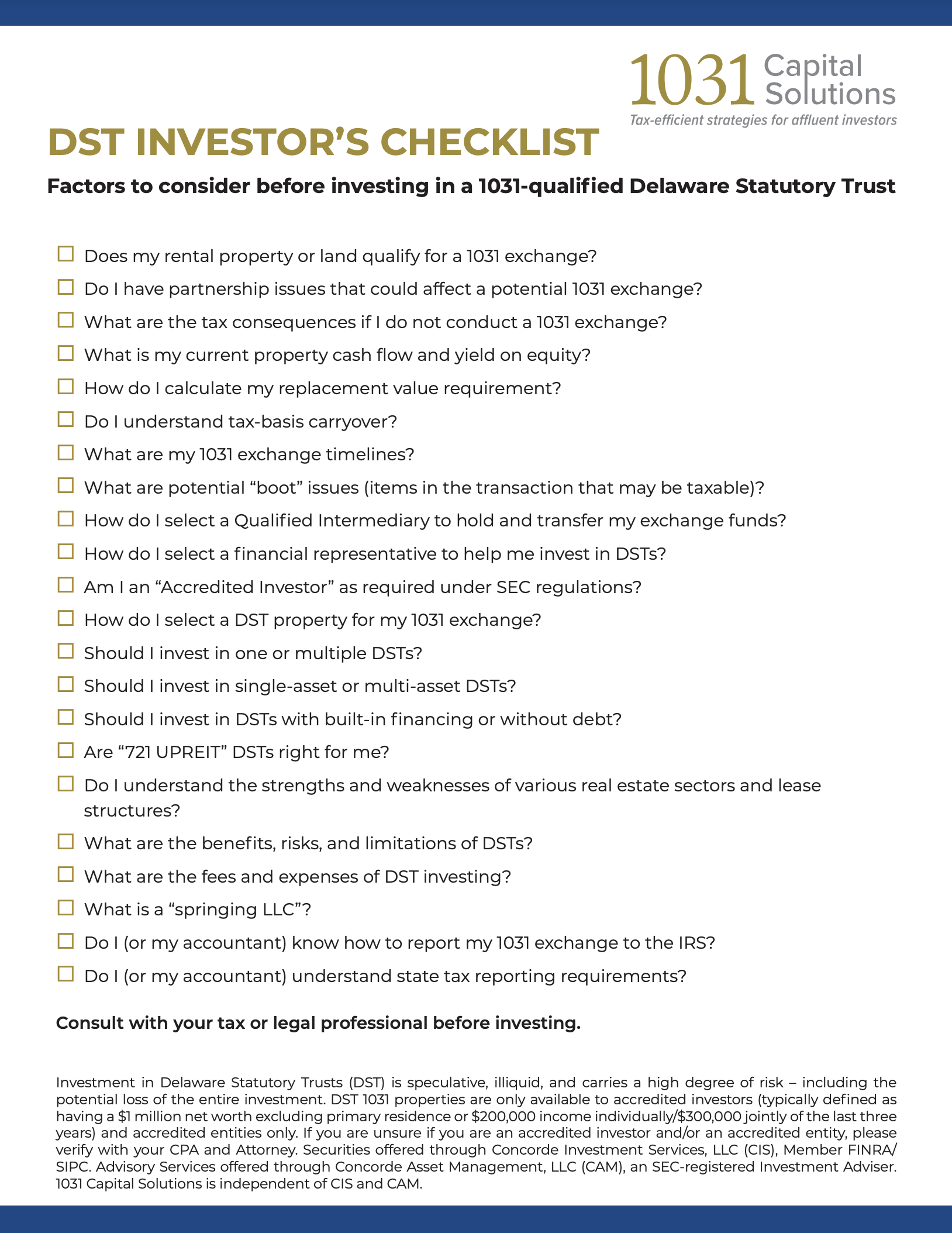

DST Investor Checklist

Factors to consider before investing in a 1031-qualified Delaware Statutory Trust

-

The ABCs of DSTsJuly 21, 2021

-

1031 Exchanges Will Be Around for Another CenturyJanuary 19, 2021

-

White House Seeks Higher Taxes from LandlordsJune 4, 2024

-

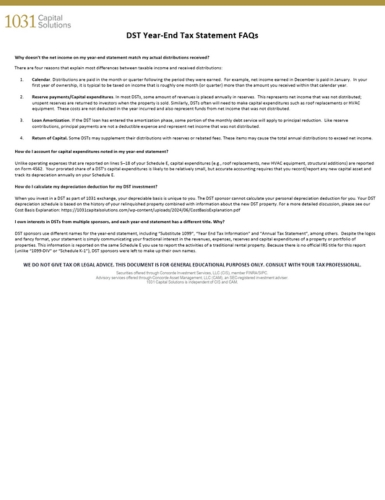

DST Year End Tax Statement FAQsMarch 11, 2025

-

DST Investor ChecklistApril 13, 2022

continue reading