The Burdens of Managing Rental Property in Retirement Retirement should […]

It is Possible to Replace your Rental Property with a […]

Real Estate and Apartment Associations Push Back on Biden Proposals […]

Trusts, Partnerships and 1031 Exchanges One crucial aspect of real […]

2024 Multifamily National Investment Forecast Marcus & Millichap’s annual forecast […]

Three Recent Surveys Mark Turn in Public Sentiment for Economy […]

Top Ten States for Rental Investments in 2024 The real […]

Disparities in Cost of Living Drive Migration and Housing Demand […]

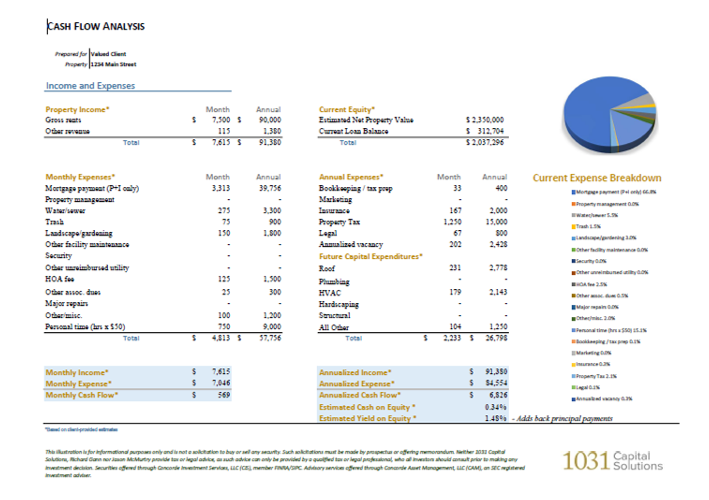

Inflation, Interest Rates, 1031 Exchanges and Cap Rates in 2023 […]

Important 2023 Tax Updates for Landlords As 2022 came to […]

Tax Benefits of Investing in Energy Programs In addition to […]

What the Falling Euro Means For the U.S. Commercial Real […]