When the Federal Reserve (the Fed) adjusts its target interest […]

1031 Industry Veterans Launch Proprietary Software for Rental Housing Providers […]

When it comes to building and preserving generational wealth through […]

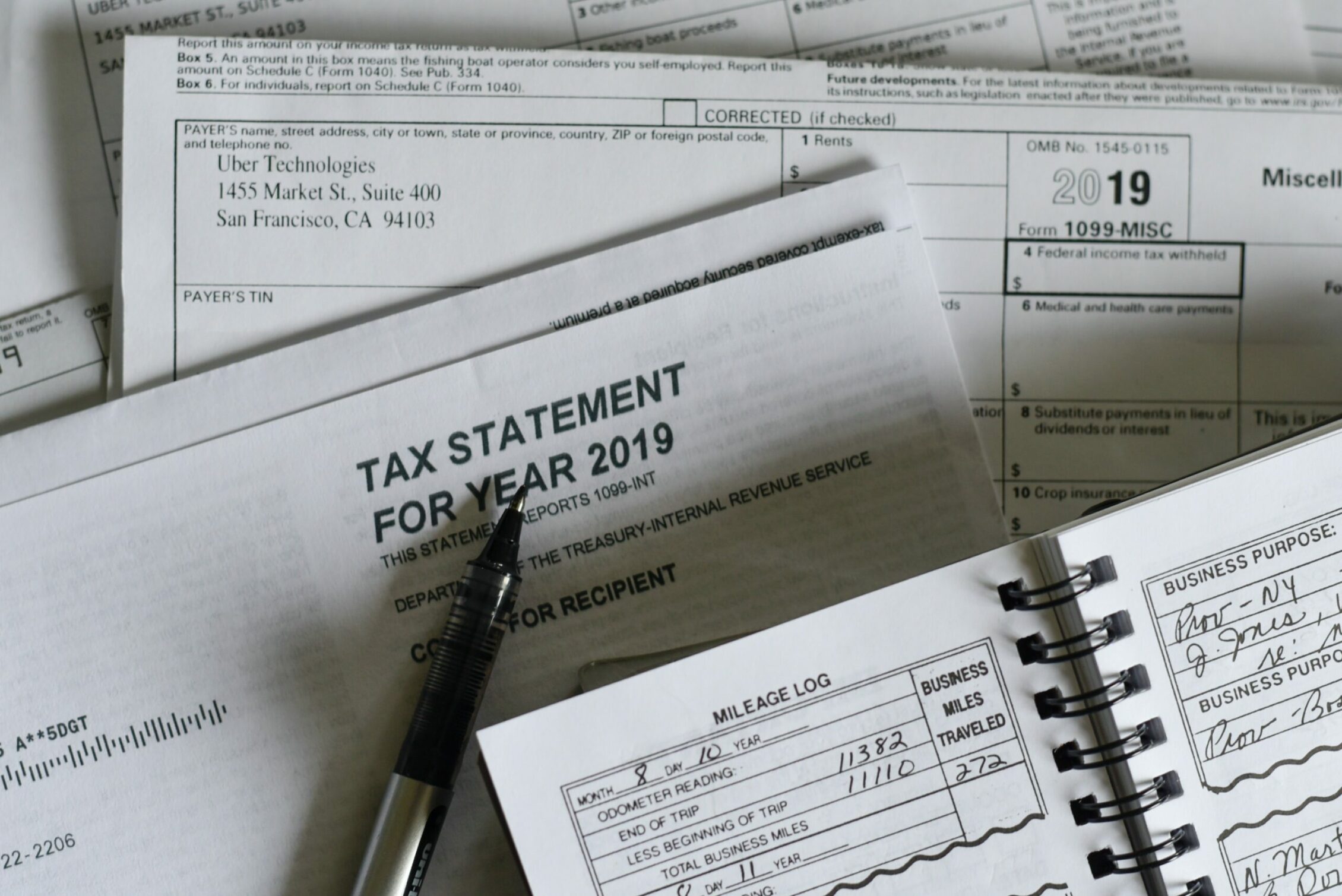

How to Report a 1031 Tax-Deferred Real Estate Exchange to […]

It May Be Time to Let Go of your SFR, […]

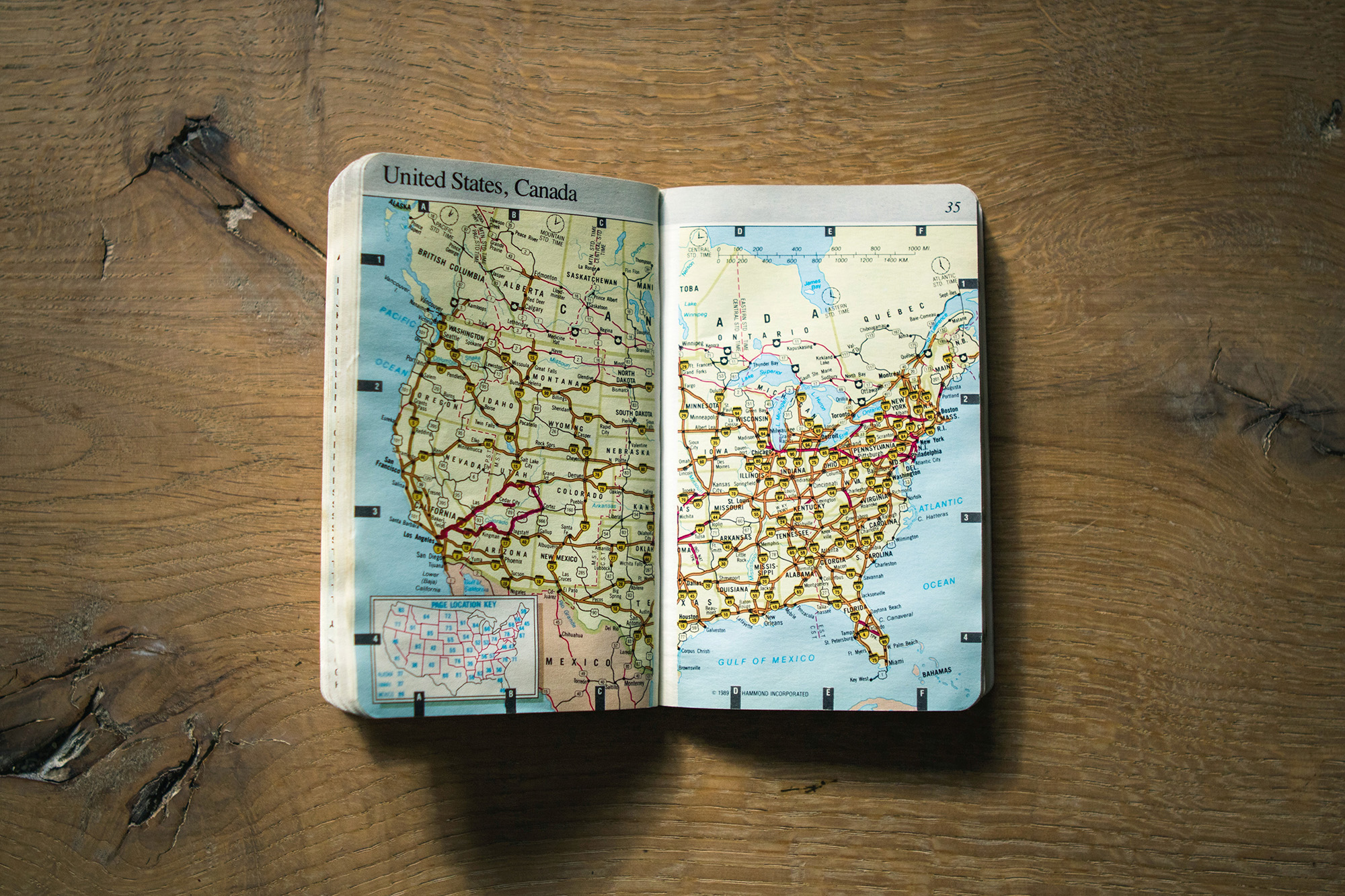

How Will Today’s Foreign Conflicts Impact U.S. Real Estate Values? […]

What the Election Means for Taxpaying Housing Providers Whatever your […]

White House Seeks Higher Taxes from Landlords In a significant […]

Upward Trajectory: Why U.S. Apartment Rental Rates Could Keep Rising […]

Your Previously Performing Real Estate Investment May Be Down. What […]

It is Possible to Replace your Rental Property with a […]

Real Estate and Apartment Associations Push Back on Biden Proposals […]

2024 Multifamily National Investment Forecast Marcus & Millichap’s annual forecast […]

Three Recent Surveys Mark Turn in Public Sentiment for Economy […]

Top Ten States for Rental Investments in 2024 The real […]

Disparities in Cost of Living Drive Migration and Housing Demand […]

Inflation, Interest Rates, 1031 Exchanges and Cap Rates in 2023 […]

Important 2023 Tax Updates for Landlords As 2022 came to […]

Tax Benefits of Investing in Energy Programs In addition to […]

What the Falling Euro Means For the U.S. Commercial Real […]

Are you a “real estate professional”? If so, you may […]

The Greatest Risk in Real Estate? The Federal Reserve. If […]

The Fruit Salad of Capital Gains and Losses You’re forgiven […]

Top 5 Reasons to Consider a 1031 Exchange in 2022 […]

The “Inflation Reduction Act” will only worsen inflation. What should […]

Three Pillars of Real Estate Wealth Preservation If you owned […]

Which Real Estate Investments Hedge Inflation Risk? In a recent […]

1031 Exchanges with Seller Carry-Back Notes During times of rising […]

Assessing Inflation’s Impact on Commercial Real Estate Investors typically consider […]

Inflation Drives Housing Further Out of Reach for Many Would-be […]

Is Commercial Real Estate’s Boom Coming to a Halt? In […]

Enjoy the potential benefits of real estate without the headaches? […]

Commercial Real Estate Forecast Looks Positive Despite Economic Challenges […]

Do You Understand the Three Basic Types of Taxes? Few […]

Are Millennials Giving Up on Homeownership? It has been said […]

Is America Officially a “Renter Nation”? Rising real-estate prices are […]

How Self-Storage Complements Multifamily The self-storage and multifamily markets are […]

Is Student Housing Ready to Bounce Back? At the beginning […]

Opinion: Concerns About Student Loan Forgiveness Richard D. Gann, JD […]

1031 Tax Deferred Exchange Safe… for Now Since November 2020, […]

What’s Ahead for Real Estate Owners with Biden’s Tax Reform? […]

10 Reasons to Exchange into Passive Properties Conducting a […]

Do Higher Values Today Translate to Higher Returns Tomorrow? […]

In decades past, the California Dream lured millions of people not only to come but to stay.

Richard D. Gann, JD, discusses the current war being waged against multifamily landlords and how to reinvest in landlord-friendly locations.

As the average waiting period to buy grows longer, demand for quality rental housing should continue to support rental rates.

Our 45-minute online presentation where you will learn about Delaware Statutory Trust (DSTs).

In this one-hour Webinar, we discuss the pros and cons of Triple Net Leases, as well as Delaware Statutory Trusts (DST).

In this educational video, we explain the basics of Delaware Statutory Trusts that qualify for 1031 exchanges (1031 DSTs).

Too often, taxes are described in the media as if they were part of nature, no less fundamental than gravity or solar radiation.

California legislators have proposed tax hikes—again, reprising failed tax bills from 2020 and 2021—that could collect an extra $22 billion in annual tax revenue for the state’s coffers.

Two years after the coronavirus outbreak upended life in the United States, Americans find themselves in an environment that is at once greatly improved and frustratingly familiar.

Are you planning to replace your current investment property for something larger? Perhaps you want to reinvest in a better location or simply diversify your holdings?

Residential landlords today are facing many challenges. In many coastal states, legislatures and city councils are imposing increasingly restrictive regulations.

Since 1954, “1031” has become synonymous with conducting a tax-deferred sale of property.