In this educational video, we explain the basics of Delaware Statutory Trusts that qualify for 1031 exchanges (1031 DSTs).

The future of the American economy is technology, and tech employers will seek to build their workforces in affordable cities with diverse, educated employees.

Too often, taxes are described in the media as if they were part of nature, no less fundamental than gravity or solar radiation.

California legislators have proposed tax hikes—again, reprising failed tax bills from 2020 and 2021—that could collect an extra $22 billion in annual tax revenue for the state’s coffers.

Two years after the coronavirus outbreak upended life in the United States, Americans find themselves in an environment that is at once greatly improved and frustratingly familiar.

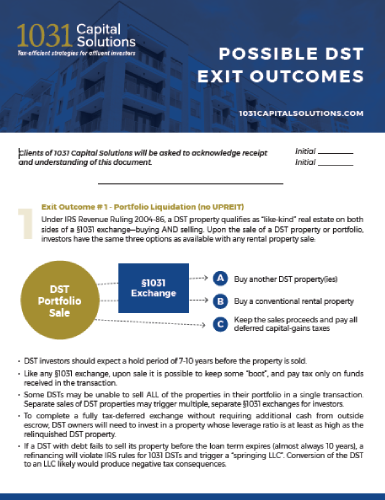

Are you planning to replace your current investment property for something larger? Perhaps you want to reinvest in a better location or simply diversify your holdings?

Under IRS Notice 2021-10, if the last day of the 180-day investment period falls between April 1, 2020, and March 30, 2021, investment deadline is postponed to March 31, 2021.

Residential landlords today are facing many challenges. In many coastal states, legislatures and city councils are imposing increasingly restrictive regulations.

Why are so many landlords exchanging their rentals for passive investments?

Each year, the Urban Land Institute and PWC publish the results of their annual national survey and research effort, known as the Emerging Trends in Real Estate report.

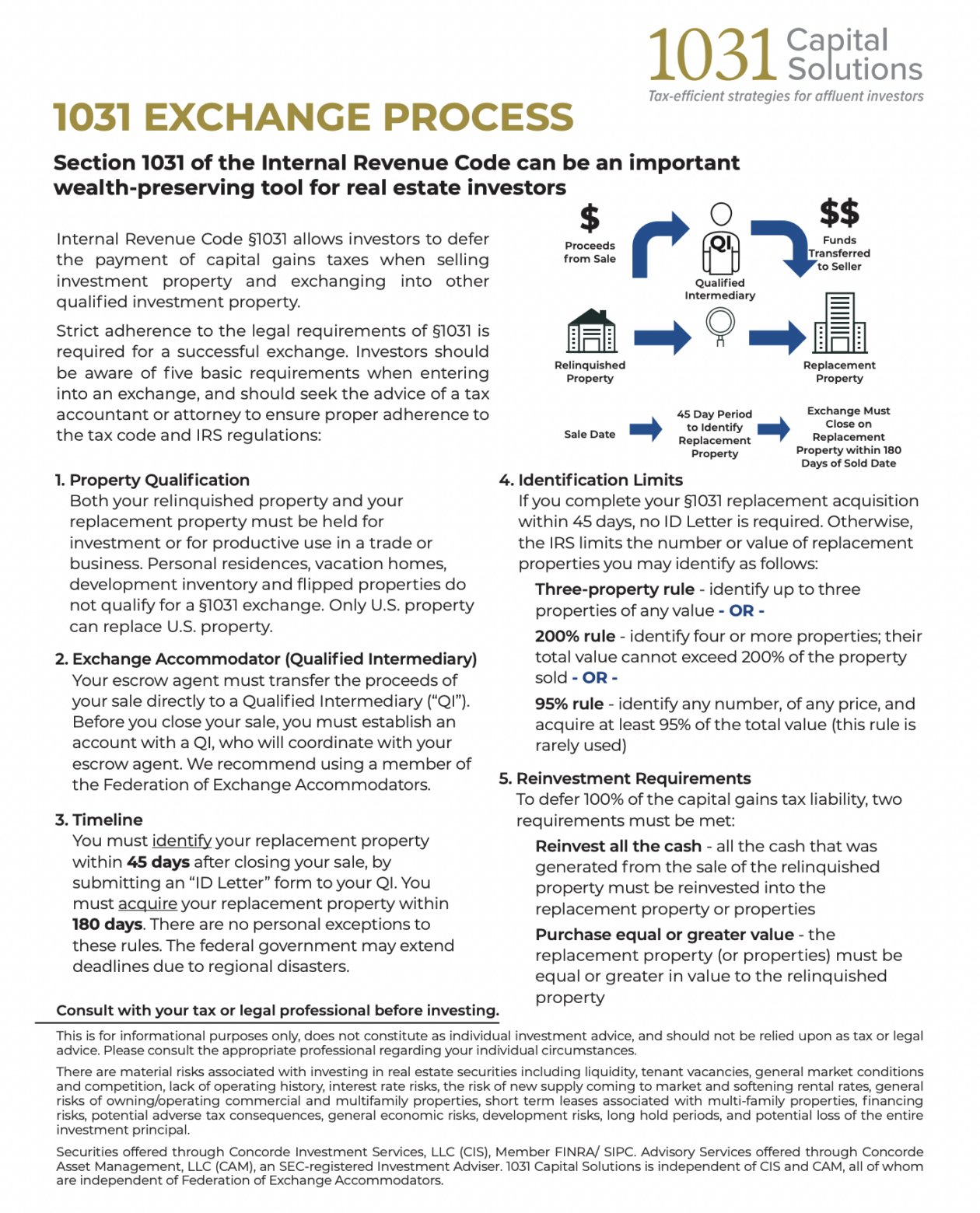

Since 1954, “1031” has become synonymous with conducting a tax-deferred sale of property.

We invite you to follow these five steps toward “retirement” from being a landlord, and 1031 Capital Solutions is here to help with every step.

Certainty, or the lack of it, drives market behavior, and there are a few things we can be certain about for 2021.

As much as we may groan about the costs and hassles of complying with myriad securities regulations, the rules are designed to protect the investing public.